The US Department of Justice intends to reach an agreement with the Binance platform, requiring it to pay $4 billion, equivalent to 3.66 billion euros at the current exchange rate.

Once reached, the agreement could allow the world’s largest cryptocurrency platform to continue operating, thus avoiding the collapse of an entity that poses a systemic risk to the cryptocurrency market, according to sources familiar with the case, cited by Bloomberg.

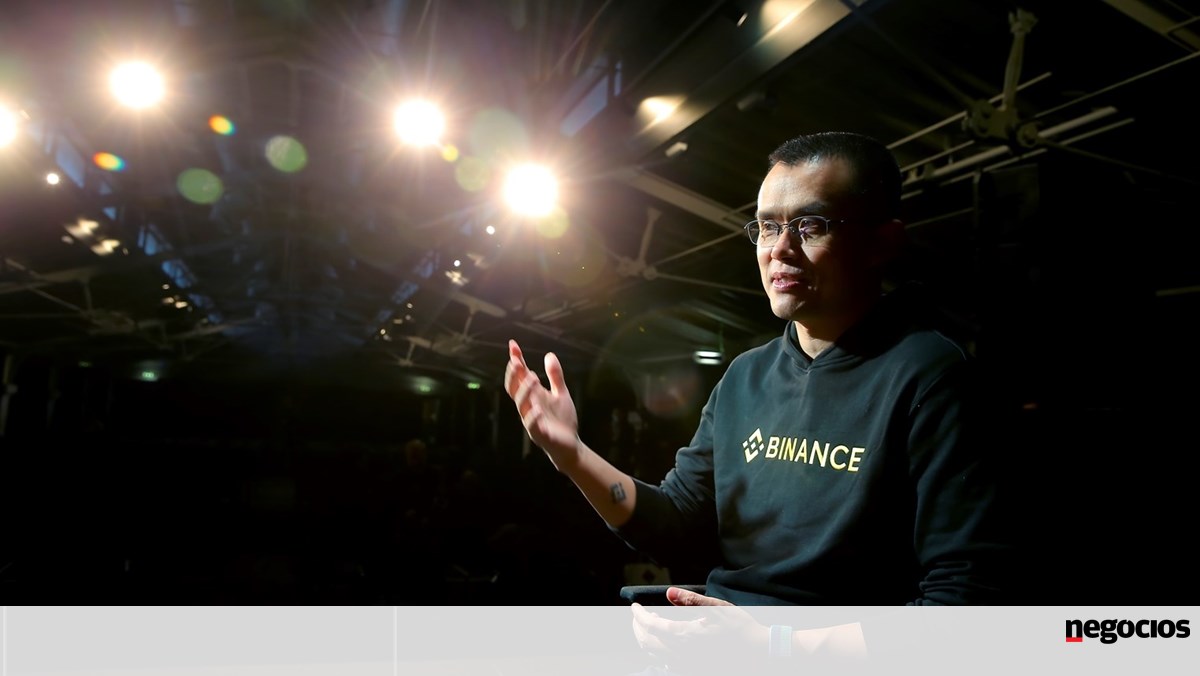

Negotiations between the Attorney General’s Office also include the possibility of Binance CEO, Changpeng Zhao (CZ), being charged by the Department of Justice. The businessman currently resides in the United Arab Emirates.

The Ministry of Justice announcement may be published at the end of this month, according to the same sources. The investigation is being conducted by the Money Laundering and Asset Recovery Unit of the Criminal Court of the Attorney General’s Office, in cooperation with the National Security Division and the Seattle District Attorney’s Office.

If the agreement reaches a successful conclusion, the United States will freeze the process against the company, but the company must provide a statement of all violations, and a process of monitoring the company’s “compliance” will be implemented.

The investigation concerns alleged money laundering, bank fraud and violations of international sanctions, specifically non-compliance with sanctions imposed by the United States on Russia and Iran.

The Ministry of Justice, contacted by the information agency, declined to comment on the news and Binance did not respond.

The Justice Department’s investigation is one of the largest in the world of cryptocurrencies, and is comparable to major operations such as US prosecutors’ actions against FTX, its CEO Sam Bankman-Fried, and other group executives.

In the case of Binance, Bloomberg notes that it is not yet clear whether there are other executives who will be investigated, in addition to Czechoslovakia.

In addition to this criminal investigation, CZ and Binance are being administratively investigated in the United States. At the beginning of June, the North American Securities and Exchange Commission (SEC) filed a lawsuit against both Binance and CZ for alleged violations related to unregistered operations, as well as the mixing of private assets and client assets. The next day it was Coinbase’s turn.

In July, CZ responded to the SEC’s announcement, explaining in a letter, which Negosius was able to access, that “not all Wall Street investment firms are Madoff,” referring to one of the largest Ponzi schemers in history.

(News updated at 6:06 p.m.)

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”