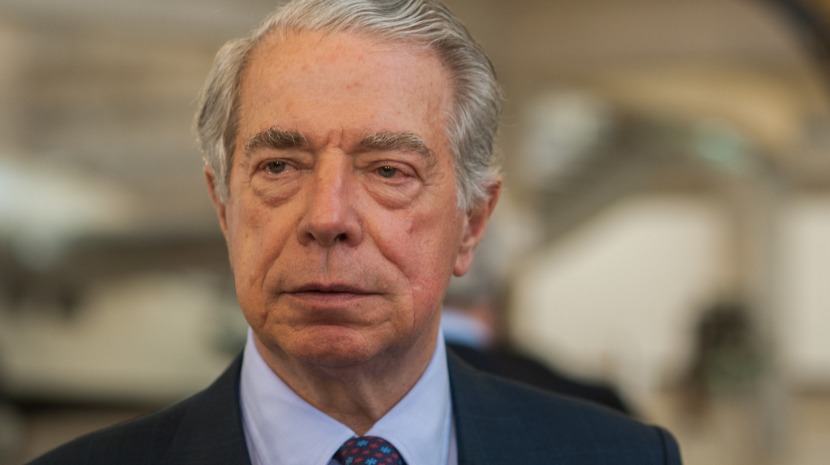

The defenses of Ricardo Salgado and the former directors of Espirito Santo Bank, who were sentenced today by the competition court to fines of between 120 thousand and four million euros, announced that they will appeal the ruling.

The defenses of Ricardo Salgado and the former directors of Espirito Santo Bank, who were sentenced today by the competition court to fines of between 120 thousand and four million euros, announced that they will appeal the ruling.

Adriano Squilacce, representative of the former president of BES, said he will appeal the decision announced today by the Court of Competition, Regulation and Supervision (TCRS), which reduced the fine imposed by the Bank of Portugal on Ricardo Salgado (BdP) in the BESA (1.8 million euros) and Eurofin (€1.8 million) operations. 4 million euros), from 5.8 million to 4 million euros, which is the maximum amount allowed in light of previous fines that are already final.

Susana Silvera, the defense attorney for former BES chief financial officer, Amilcar Moraes Perez, was sentenced to a fine of €3.5 million – a reduction of €4.7 million in the administrative decision (1.2 million from the BESA operation and 3.5 million from Eurofin) – declared her “total disagreement”. “With the decision and part of the reasoning that Judge Mariana Machado read today.

The representative of Jose Manuel Espírito Santo Silva, who has been fined €1.250 million by the British Development Bank under the Eurofin operation, said he was satisfied with the decision announced today, which was merely a warning and recognition that the former director of Espírito Santo Group had not acted with intent, Rather negligently.

Rui Patricio also highlighted the fact that the TCRS took into account the state of health of José Manuel Espírito Santo and considered, in its favour, the effects of his behavior, both before and after the BES decision, that is, the fact that he was only one person publicly apologizing for what had happened to the bank.

Gerardo Petracchini’s lawyer, Carlos Almeida Lemos, referred to a “significant amount” of the fine imposed on his client – the TCRS maintained a €120,000 fine from the administrative decision (related to the BESA process), suspended in three quarters for a period of five years – asserting that his client, Who lives in Italy, is still unable to work in the region and lives “without income”.

In the case of Rui Silvera, who saw the fine of 400,000 euros reduced by the TCRS to 120,000 euros, lawyer Luis Perez de Lima joined the request of lawyers who complained about the decision of Judge Mariana Machado, who issued her ruling in the name of as soon as it ended, after reading the summary of the sentence, He was allowed 12 days to appeal and respond.

To the lawyers who declared that they would seek the nullity/irregularity of the order, Mariana Gómez Machado indicated that the legally established period for appeal is ten days, noting that the appeal to the Lisbon Court of Appeal can focus only on questions of law, which, in this case, ” The defendants know him well.”

However, he ended up being given three more days, stating that the operation was of an urgent nature due to the risk of prescriptions.

In today’s decision, based on 1,900 pages, the TCRS rejected the appeal made by Ricardo Salgado as completely unfounded, convicting the former head of BES for 10 offenses, which, in addition to the law, corresponds to a single fine of 4 million euros, which is the maximum Permissible in light of previous convictions for administrative offenses.

Violations indicate failure to implement regulations or procedures that would allow monitoring of operations carried out by BES Angola or credit risk analysis operations contracted with this branch, and failure to comply with mandatory reporting duties to BdP of problems associated with BES credit, credit and real estate portfolios.

Salgado also affirmed the conviction of the malicious practice of destructive management practiced at the expense of depositors, investors and other creditors, and of wrongful disobedience to the decisions of the supervisor, such as feeding the escrow account (escrow account) with resources outside Espirito Santo. Santo Finantial Group and commitment to eliminating unsecured ESFG exposure to ESI/ESR.

Within the scope of the Eurofin operation, I was also found guilty of offenses such as non-compliance with the prohibition on increasing direct and uncovered BES exposure to ESI (letters of convenience), as well as direct or indirect marketing of debt from non-financial entities of the GES subsidiary with retail clients.

The remaining administrative offenses confirmed today relate to disobedience to the prohibition of granting direct or indirect financing or refinancing to GES financial entities that were not part of the BES group and to violation of the rules regarding conflicts of interest.

Amílcar Morais Pires also saw the TCRS reject his appeal in full, convicting him of seven infractions, three related to the BESA process (concurrent with that applicable to Ricardo Salgado) and four to Eurofin.

Gerardo Petracchini was found guilty of negligence on two counts, for failing to implement the internal control systems imposed by BdP Notice 5/2008, and for failing to identify deficiencies in internal control by the ESFG.

Roy Silvera’s appeal was dismissed in part, after he was found guilty of negligence for failing to inform the supervisor of problems associated with BESA’s credit and real estate portfolios.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”