We live in a period of high prices and instability. In addition to energy, fuel and housing credit also, due. An increase in interest rates.

Watch some simulations of housing credit and get ready for October.

Those with home loans that will be reviewed in October will feel the (massive) increase in interest rates felt since the beginning of the year. According to an article published by TVI, taxpayers with a housing credit covered by the "Família Primeiro" program, through which they will receive 125 euros from the state to meet the general rise in prices, may not have the time or opportunity to make significant expenses, if the housing credit is reviewed in the following month.

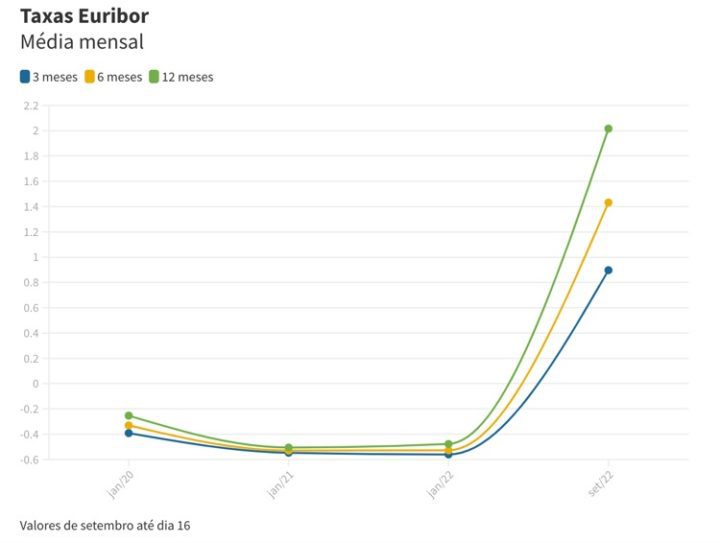

The problem is high interest rates, specifically to fight inflation. Euribor prices are on the rise, too.

Home Credit - Simulation

The contracts reviewed in October that will feel the premium increase are those indexed to Euripur 12 months. For a loan of 150 thousand euros for a period of 30 years with a difference of 1% the premium will be increased by more than 40%. The holder of this contract has paid just over €449 per month since October 2021, but will now pay more than €633. The increase is more than 184 euros.

In indexed contracts Euribor to six monthsAlso, the height is expressive. In this credit, the premium is just over €454 since April, but from October onwards it will exceed €587 (an additional €133 per month).

In contracts indexed to Euribor for a period of three months, the effect is less. The premium is €466.17 since July and will rise to €546.74 from next month (another €80 a month).

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”