On Monday, Mota-Engil announced the results of an initial public offering (OPS) and two public exchange offerings (OPT) with a global value of €110 million in bonds, in which more than 4,800 individual investors participated. The operation was completed successfully, with the builder able to determine the total amount intended.

According to a statement, the construction company placed the requested amount with a total order of 155.59 million euros, which is 1.41 times more than the value of the final issue and 2.07 times more than the initial value of 75 million euros.

The issuance of the new Mota-Engil 2026 bonds made it possible to offer 40.05 million euros, the total amount of the IPO (OPS), with a valid order exceeding 63.4 million euros. Once the order value exceeded supply, the global amount of orders was divided into a value of 1.29 million euros, with a division factor of 0.289 applied.

According to the data presented on Monday, on the 23rd, the day the bid was raised from 75 to 110 million euros, the offer has already exceeded the amount allocated to the retail sector: 81 million euros.

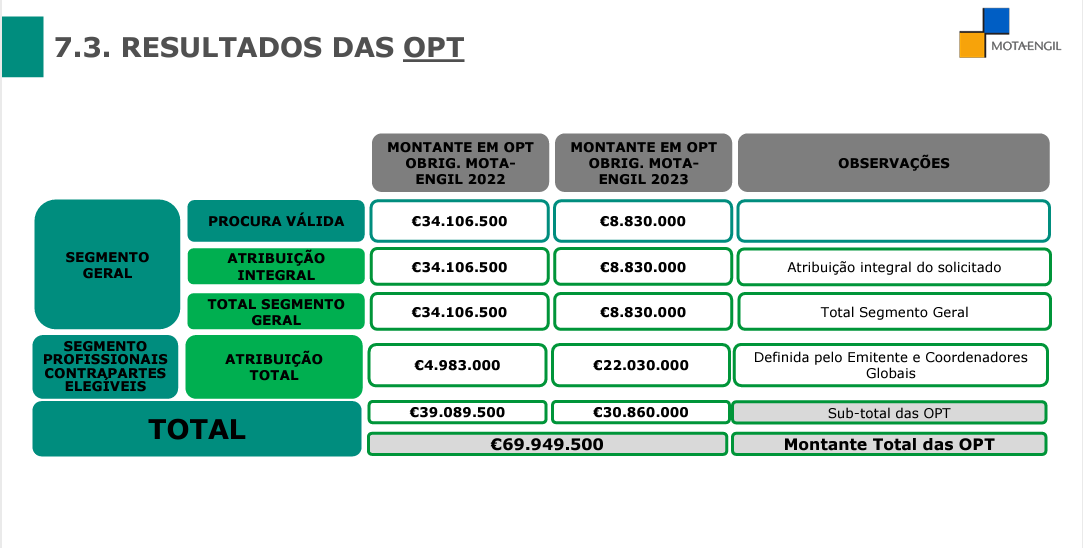

In conjunction with this offering, there were two stock market offerings (OPTs) in operation, maturing the following year and the following year. These are for up to 150,000 Mota-Engil Bonds 2022 (with a face value of €500 per unit) and up to 6,051 Mota-Engil Bonds 2023 (with a face value of €10,000 per unit). These exchanges also included a premium.

The OPT reached €69.95 million – 39.09 million in the line that was due next year and another 30.86 million in the Mota-Engil 2023 issue.

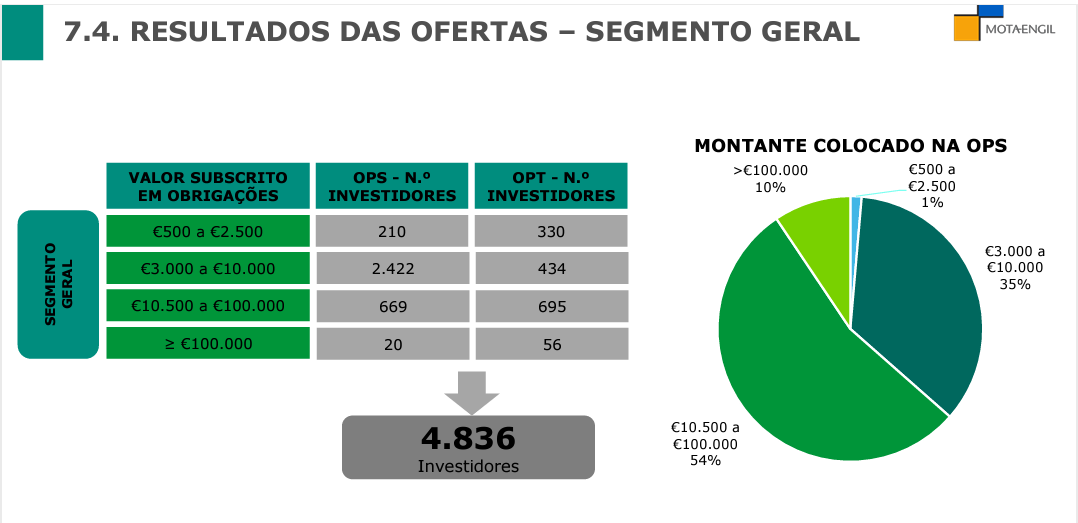

The IPOs collected 4,836 investors in the period between OPS and OPT.

“Overall, the bond issuance, with a maturity of 5 years, met all the objectives set, allowing the Mota-Engil Group to extend the maturity of the debt, achieving a total value of 110 million euros in the process, for strong demand in the week,” the company said in a statement. The first prompted the issuer to significantly increase the value to absorb the market interest.

Half of the orders were placed between 10 and 100 thousand euros

The bulk of the issue amount was placed in the range between 10.5 and 100 thousand euros. According to the display of the operation results, 54% of the order quantity was placed in this range.

Between 3,000 and 10,000 euros were put up, representing 35% of the bid, while 76 investors placed orders over 100,000 euros, representing 10% of the total. Orders up to €2,500, the minimum transaction value, represent only 1% of the total.

The largest number of investors – 2856 – placed orders worth between 3,000 and 10,000 euros.

Retail investors secured orders of over €106 million, with a maximum of €81 million for this segment.

The new bonds will be accepted for trading on the 2nd of December.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”