Polysilicon prices recorded a slight decline this week to offset the significant decline in production in June.

The average transaction price for n-type polysilicon fell to CNY 41.8/kg, while granular silicon fell to CNY 35.3/kg, a 5.4% decline from the previous week. Prices for p-type polysilicon have remained relatively stable.

Polysilicon prices and production cuts fall in June

A significant increase in polysilicon market transactions was observed this week, along with an increase in inquiries. Many chip manufacturers have ramped up purchases, and some have begun accumulating inventory.

Industry experts reveal plans for major production cuts in June, especially among the four major polysilicon companies.

One company will reduce production by more than 10,000 tons, while another company has abandoned its reduction plans. In addition, at least five second- and third-tier companies are expected to join the reduction efforts, with two companies planning to stop production completely in June.

Recent guidelines issued by China's State Council, including the “Energy Conservation and Carbon Reduction Action Plan 2024-2025,” emphasize improving non-ferrous metal production capacity and tightening approvals for new projects. The plan requires new polysilicon designs to meet advanced energy efficiency standards.

Due to reductions in production and increased demand for acquisitions,… Polysilicon production In June, it is expected to decrease between 30 thousand to 40 thousand tons, which exceeds the 20% reduction.

This factor could stabilize polysilicon inventory levels in the short term and lead to a price rebound.

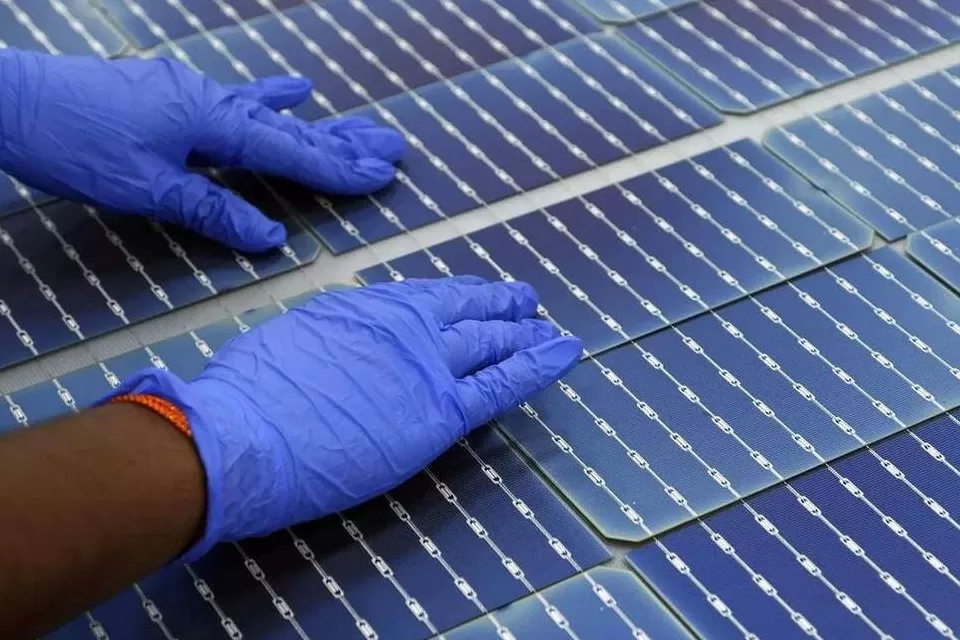

The chip and solar cell sectors are facing falling prices

In the chip and solar cell sectors, prices continued to decline this week. Intense market competition has driven down prices for many chip models, leading companies to increasingly reduce or stop production.

Chip prices are expected to remain low until production capacity returns to normal.

The solar PV sector is also facing weak market demand. While some leading TOPCon manufacturers have scaled back operations, most companies remain cautious.

As inventory levels rise, there is an imminent risk of further decline in solar cell prices.

The solar panel sector is also seeing a decline in prices

Meanwhile, the modular sector saw a slight decline in prices this week. Statistics from major entities show that the average bid price for p-type modules in May was CNY 0.82/W, A decrease of 2.3% compared to the previous month.

Likewise, the average supply price of n-type modules fell to CNY 0.874/W, a decrease of 1.2%.

Due to policy changes, the solar PV industry installation market remains cautious, resulting in lower solar module commissioning rates and a gradual increase in inventory levels.

Price stability in the solar industrial chain

In general, prices along the solar PV industrial chain continue to seek stability, With solar module prices facing downward pressure.

What you should know about self-consumption of PV energy

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”