In light of the news of gas shortages in Europe, both WTI and Brent oil – the latter a benchmark for the European market – were trading at significantly higher levels, driven by the prospect of a global energy crisis, driven by increased demand in many countries.

Oil shortages across much of Europe, due to increased travel demand now that restrictions are lifted, have pushed oil markets to new highs.

Technically, WTI broke above $73.35, turning it, says ActivTrades, “into a support zone, which is paving the way for a new rally around $76.15 (76.40% Fib). In the London market, Brent crude futures at the end of September reached $79.16 a barrel, the highest value in three years.

Regarding thermal coal, spot and futures market prices are up with deliveries scheduled for next year, as we haven’t seen since 2008. Futures contracts on this material, in the North American market, posted a 242% increase since last year, following the trend on Monday. , with a 12% increase in price, according to data from Bloomberg.

To Nuno Souza Pereira, Head of Investments at Asset Securities Manager, Sixty Degrees, andThis upward dynamic that has been going on since mid-May has been fueled “in the first stage by the huge demand for construction metals, such as steel where coal is essential for its production and pressure on gas emissions control which, with lower energy demand during the slowdown in economic activity and mobility due to the pandemic, It has led to increased closures of mines and coal production plants around the world.”

As the analyst asserts, “this phenomenon has also increased recently in China.”

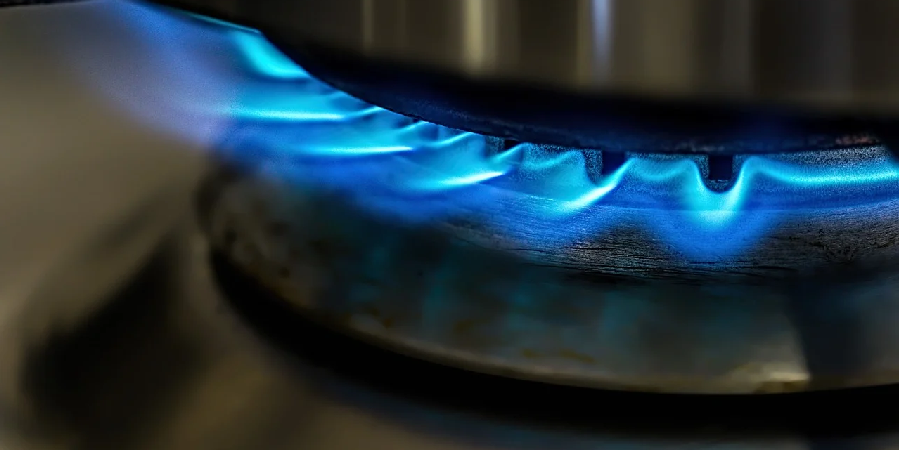

“In the second stage, the lack of available energy, namely in Europe for the coming winter, which prompted Europe to meet the objections of the United States in the construction of the pipeline with Russia, Nordstream 2, which also led to a sharp rise in prices of natural gas on the international market (doubling since April).

“From the UK, there is also worrying news, due to a fire in an electrical connection cable to France, a market from which the UK expects to import energy, as usual, during the winter,” adds Nuno Souza Pereira.

“Thus, it seems that the conditions are ripe for an ideal “small storm” in energy markets, including oil prices, “concludes the expert.

In desperation, Europe turns to coal

The gas crisis is spreading all over the world. Faced with shortages, European electricity producers are forced to set aside climate goals and switch to coal. According to Bloomberg, a major European center expects a new shipment of this substance at $200 per metric ton to arrive early next month, the largest since 2008. The agency collected data from the GlobalCOAL platform, but the company in question requested anonymity.

Europe is facing an unprecedented energy crisis after a long winter that ran out of mass stock. Unrestricted buying from Asian countries, and limited supplies from Russia and Norway, pushed companies from the old continent to fight “fire and iron” for LNG in the spot market.

During a conference in Dubai this week, Marco Salfrank, who is in charge of giant Axpo Solutions AG’s business in Europe, was clear: “We have already begun to turn to the coal market, but here too we are starting to get upset.”

“We are seeing some tightening in the coal market as well,” said Marco Salfrank, head of continental European trade at Axpo Solutions AG, in an interview at the Gastech conference in Dubai this week. Coal plant profits “became positive, which led to increased production.”

Coal supply has also fallen as major producers in Colombia and Indonesia scramble to combat torrential rains and disruption caused by the pandemic. According to the executive, due to the new climate goals of major powers, such as Europe with its “Fit for 55” program that establishes carbon neutrality to 2030, investment in new mining projects has almost stalled in recent years, with banks reducing loans to this type of business .

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”