Contrary to what investors expected, the Fed's meeting on Wednesday gave indications that, in principle, there will be no change in interest rates in the final month of this quarter.

At its North American Fed management meeting in January, its officials changed the perception of the upward trend from the previous meeting, but said in a press conference that “this trend is not expected to continue.” It would be appropriate to lower the target range until greater confidence is gained that inflation is moving sustainably towards 2%.

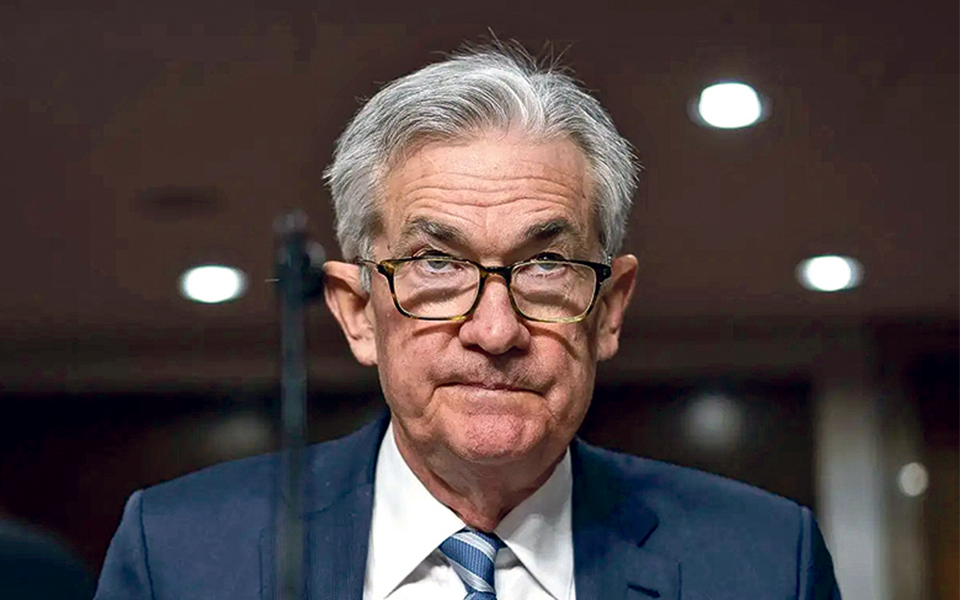

During his press conference, Fed Chairman Jerome Powell initially seemed to suggest that the barrier to greater confidence had not yet arrived: Confidence is rising, but we want more. “I want to see more positive data.”

Analysts at Goldman Sachs point out in a statement that although the Fed has changed its focus from six-month annual inflation rates to highlighting annual rates, “which are about a percentage point higher, at 2.9%,” the central bank noted. Until the level of inflation actually decreases. “A very positive development and a very rapid decline” and “Likely to continue to decline.”

Powell also made clear that his administration does not need to see any deterioration in economic activity or labor market data to cut interest rates. He also expressed concern that the impact of the current high levels could be negative. But it will be temporary.

For the bank, everything seems to be opening the door for a cut in March. However, a reduction in March may not be the case, Powell said. Goldman Sachs says in this context: “We see this statement as a strong signal, although Powell did not completely rule out a March cut. The head of the institution stated that “there are risks that could occur that push us to move faster or earlier.”

Goldman recalls that more than 50% of North American investors are betting that interest rate cuts will begin in March.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”