As Bitcoin and cryptocurrencies in general begin to show signs of recovery, new data reveals whale tokens Ethereum They are more interested in accumulation.

Data recorded on the blockchain shows that the largest ETH whales are very interested in the metaverse ecosystem. So they are buying MANA, the Decentraland metaverse token.

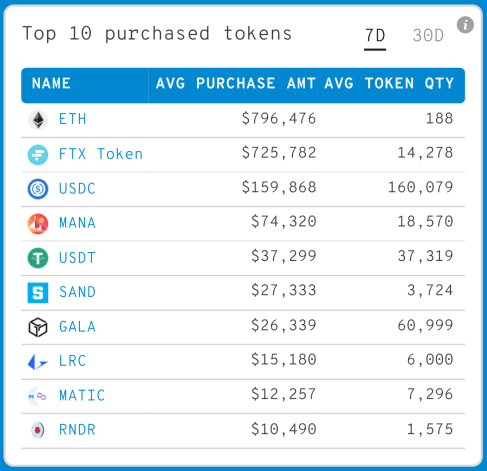

The data that the tracker calculates Whale It showed that, on average, every MANA purchase made by an ETH whale totaled $74,320, on average, in the past seven days.

But MANA is not the only gamecoin Ethereum investors are looking forward to.

This is because whales also collect original game tokens to earn play. This includes The Sandbox (SAND), with an average purchase value of $27333 per transaction.

Metaverse icons

In third place is the gaming ecosystem token Gala (GALA), averaging $26,339 per Ethereum whale purchase.

It is noteworthy that all three crypto activities have seen very volatile price movements in recent days, along with the rest of the markets for Cryptocurrency. However, it has been reclaiming its value and rising by more than 20%, as is the case with SAND.

At press time, MANA is at $5.11, up 16.6% in the last 24 hours. Meanwhile, the SAND price is up 27.23% in the last day and is trading at $7.61. Finally, the GALA token is up 25.3% in the same period and is trading at $0.72.

Prefer Altcoins

Looking at the top 10 coins bought by Ethereum whales, there are also stablecoins. In this case, USDC purchases override USDT purchases in preference to whales.

In addition, large investors are also massively buying the FTX token from the exchange of the same name, which indicates a high volume of traders in the market. Ethereum on the platform.

Another token that whales are buying is one of Ethereum’s competitors, Polygon (MATIC). The token that fuels a blockchain focused on smart contracts has been cited as a major competitor to ETH.

Read also: Analyst Predicts Bitcoin Movement After Fresh 8% Rebound

Read also: Bitcoin mining difficulty drops and breaks biggest uptrend since 2018

Read also: Twitter CEO Jack Dorsey resigns after criticism and pressure

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”