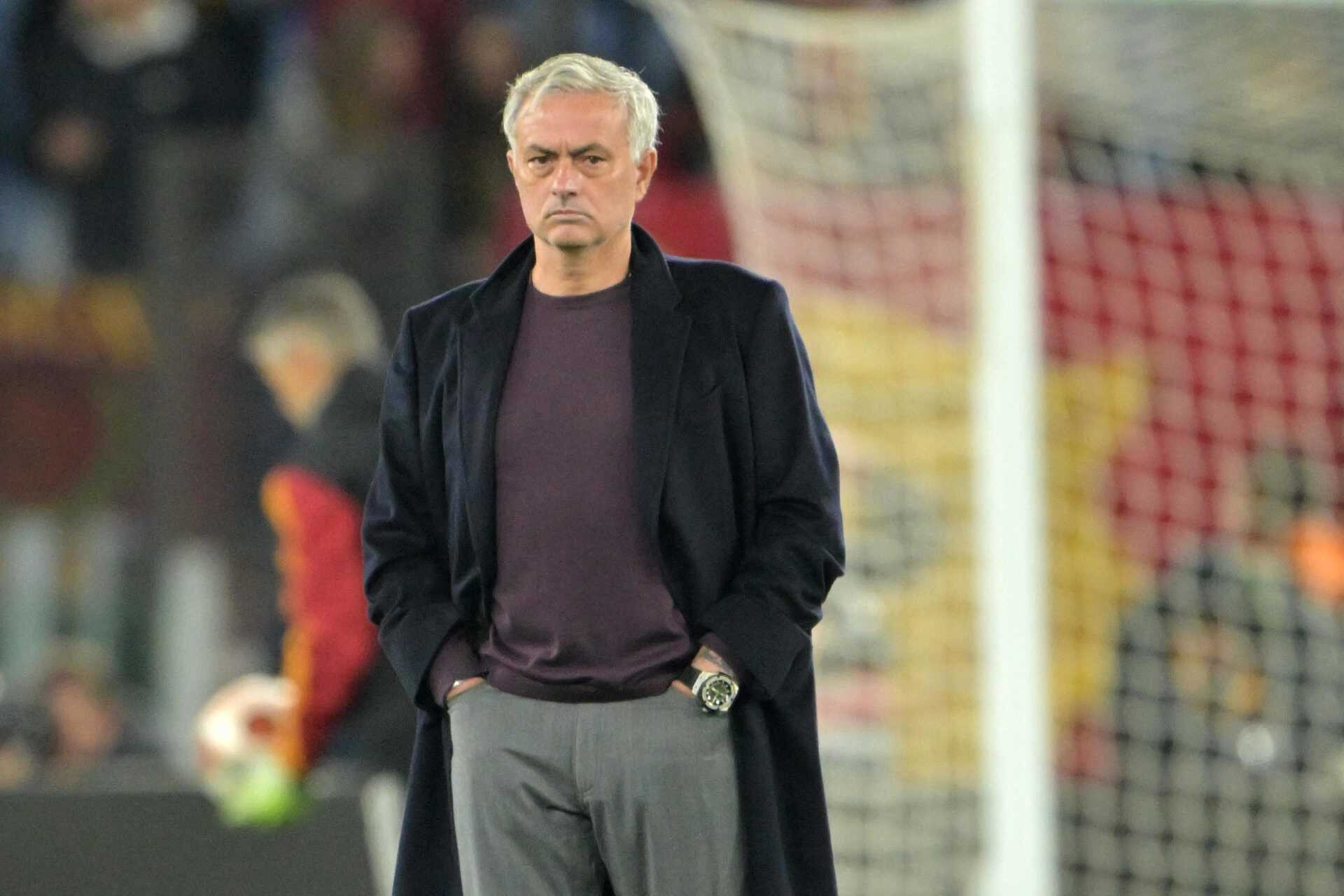

The Spanish Supreme Court confirmed on Tuesday that Jose Mourinho must pay a debt corresponding to the tax settlement of the personal income tax (IRPF) from 2011 and 2012, when he was managing Real Madrid.

In 2018, the Central Economic Administrative Court rejected the Portuguese coach's complaint regarding the Portuguese League for the period 2010-2012, resulting in a fine of €571,073 and a settlement agreement of €881,368.

The National Hearing canceled the penalty and deemed the Tax Administration's right to collect the corresponding debts for 2010 as severed, but retained the debts for 2011 and 2012.

Jose Mourinho appealed the settlements, considering that the amounts to be taxed were incorrect, and claimed that part of the aforementioned amount was not related to salaries, but rather to the Gestivot company responsible for mediation in his contract with Real Madrid.

The Supreme Court has now rejected the appeal, a decision requiring the Portuguese coach to pay debts related to the years 2011 and 2012, considering that the total income he received was not declared, that is, it was not included in the IRPF declaration.

In Spain, the IRPF applies to all residents of the territory and is levied on income earned in the country.

“Writer. Communicator. Award-winning food junkie. Internet ninja. Incurable bacon fanatic.”