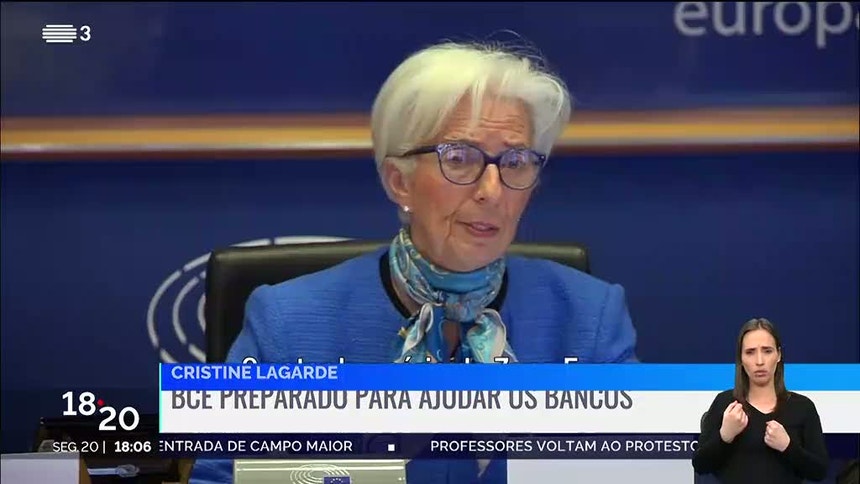

During the “Economic Dialogue”, with the Parliamentary Committee on Economic and Monetary Affairs of the European Parliament sitting in Brussels, and in her capacity as the Chairman of the European Systemic Risk Board, ESRB, Lagarde emphasized that Individual financial institutions must carefully maintain their current levels of flexibilityto ensure their ability to withstand a potentially less favorable environment.

Recalling the current tense environment caused by the bankruptcy of SVB Bank of America and the loss of 25 percent on the Credit Suisse stock exchange, The head of the European Central Bank stressed that the institution is ready to intervene “if necessary”, In order to maintain financial stability in the euro area.

“In terms of financial stability, we have all the tools that will be necessary, that will be necessary in the end, to face the tensions,” the ECB President emphasized. Even if these tools prove insufficient, The ECB will be able to “provide necessary adjustments or recalibrations to meet any liquidity risks.”.

Call to regulate non-bank financing

As Chair of the European Systemic Risk Board, Christine Lagarde has made several criticisms and pleas in order to minimize the effects that may be exacerbated by the volatility of the non-bank financial sector.

“There have been several periods of market volatility in recent months, which have caused liquidity difficulties for non-bank financial intermediaries. We analyze such events very carefully,” said Lagarde.

“The ESRB has repeatedly called for regulatory reform of the non-bank financial sectorRemember. ” In particular, we point out The need for a wide range of tools to deal with systemic risks related to brokersHe added, “My predecessor and I have presented this problem to this committee many times.”

“Overall, progress so far has been scanty,” he criticized.

Lagarde stressed, however, that “the banking sector in the eurozone is resilient, with strong capital and liquidity positions”.

However, the ECB President reminded MPs that in September 2022, the ESRB published a public alert on weaknesses in the EU’s financial system.

Not everything in this warning has been met. Growth forecasts have been revised upwards for 2023 and perceived risks to short-term growth have eased. “Although a slowdown in economic growth is expected this year, the EU economy has proven to be more resilient than expected,” Lagarde said.

but, “Developments in financial and banking markets in recent weeks highlight the need to maintain vigilance about vulnerabilities In a challenging macro financial environment.”

Credit Suisse effect

Lagarde also praised the “quick actions and decisions taken by the Swiss authorities” regarding the strong decline in the Credit Suisse stock market.

On Thursday, the Swiss bank became the first major bank to receive public emergency aid since the 2008 financial crisis.

However, the President of Switzerland, Alain Berset, announced on Sunday that the Swiss banking group UBS will buy Credit Suisse, saying that this is the best way to “restore confidence”.

The negotiations that culminated in this process included, in addition to the two banks, the Swiss government and the central bank. UBS will now benefit from a guarantee of nine billion Swiss francs (€9.11 million) from the government, to act as insurance in case problems are detected in very specific Credit Suisse portfolios..

The central bank also announced a liquidity line of up to 100 billion Swiss francs (102 billion euros) for UBS and Credit Suisse.

The news of the merger, which circulated before the markets opened, did not immediately have the expected positive effect.

Meanwhile, Lagarde in Brussels confirmed this The exposure of European banks to the difficulties of Credit Suisse is “very limited”, in the order of “millions”.Especially with regard to the liabilities that evaporated with the merger with UBS.

Lagarde said the exposure of ECB-monitored institutions in the eurozone is “very limited with respect to Credit Suisse, particularly with regard to AT1 (debt securities)”. “We are talking about millions.”

Repeated reassurances by the governor of the French central bank and the heads of Deutche Bank and Commerzbank.

AT1 bonds were created after the 2008 crisis and are credited to the bank’s own funds account.

The Swiss authorities have decided that the holders of these bonds will bear part of the financial burden resulting from the merger between Credit Suisse and USB, in favor of the former shareholders. A different solution would be the Eurozone, where equity holders would be “the first to absorb losses”, as the ECB noted this morning.

w/ portuguese

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”