If you are excited by the news and like it, know that this new Apple product has not yet arrived in Portugal. The Cupertino company has launched a new product for the financial sector that allows customers in the United States to put their money into a savings account with an annual interest rate that, as the company guarantees, is “ten times higher than the national average.”

Apple is one of the companies with the largest credit card database in the world. Moreover The company also has its own card, the Apple Card. Linked to Apple Pay, this card provides huge benefits to users.

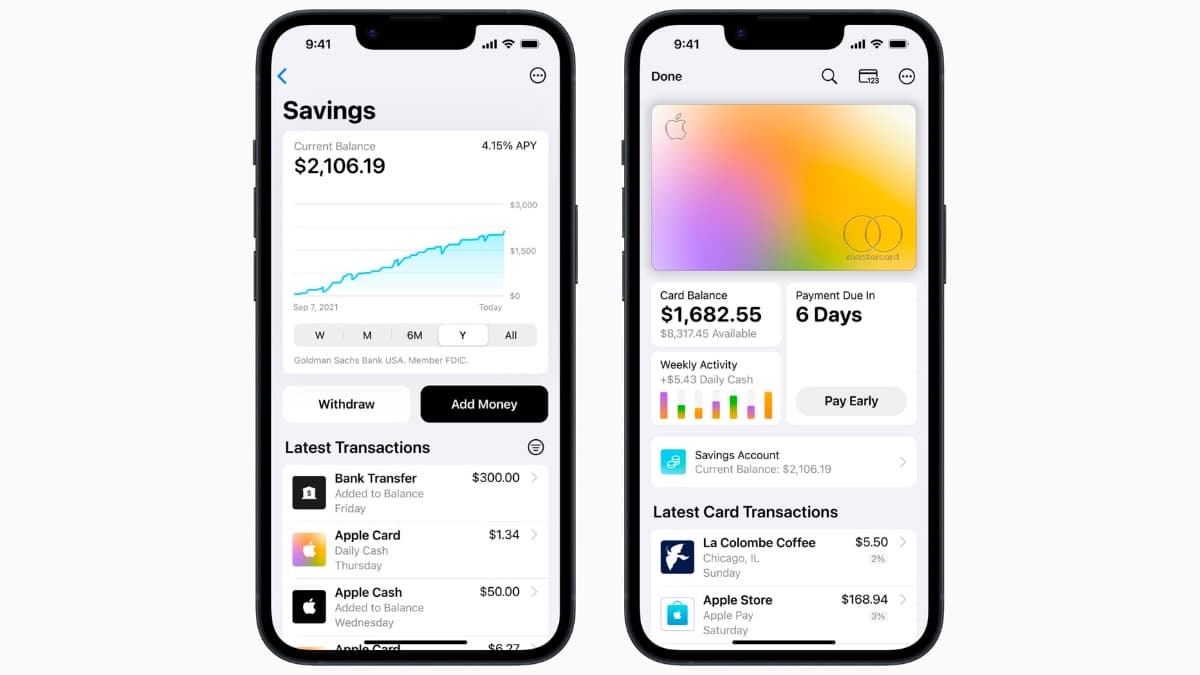

For example, it has no annual fee, and allows the user to pay interest-free Apple products in installments, there Cashback 3% off all purchases from Apple and participating partners2% when you buy something with Apple Pay, and 1% on all other purchases.

No, that's not all yet. In addition to the advantages mentioned above, exemption from fees in foreign transactions is now added, the ability to show the user's earnings in daily transactions, it also shows the place on the map where purchases were made and even gives some suggestions on how to make certain payments. Everything for the user to get the most out of this card.

Apple Card also has a savings account with over 4% interest

Of course, Apple is not just a company. It has a very rich ecosystem, and a great tentacle. Physical stores are spread over about 25 countries and a huge sales organization.

As such, to expand its presence in the financial sector, apple Create a savings account now. This product lives up to the promises announced in October last year. This new service, Apple says in a statement, will be managed by Goldman Sachs, and is currently only available in the United States.

a The offered interest rate is 4.15% p.a, "ten times higher than the national average" — which is about 0.37 percent — the company says. Unlike what happens in many banking institutions, it is not necessary to pay commissions, and there is no minimum deposit required to maintain or open an account, which can be managed through the Wallet app. The maximum account balance is $250,000.

Is it only for the United States?

The Apple Card did not arrive in Europe. However, this product may not be only for the United States. According to Apple, despite being limited to North American territory at an early stage, The service will later be available in the United Kingdom, Canada and Australia. If it succeeds, Europe is also in the crosshairs.

Our goal is to build tools that help users achieve a more sustainable financial life, and including an Apple Card savings account in Wallet allows them to effortlessly spend, send, and save money on a daily basis.

Apple said.

This timing comes a bit of an opposite cycle. Banks, even American ones, limit interest on deposits. Apple launched something that can attract a lot of people to the product at this time.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”