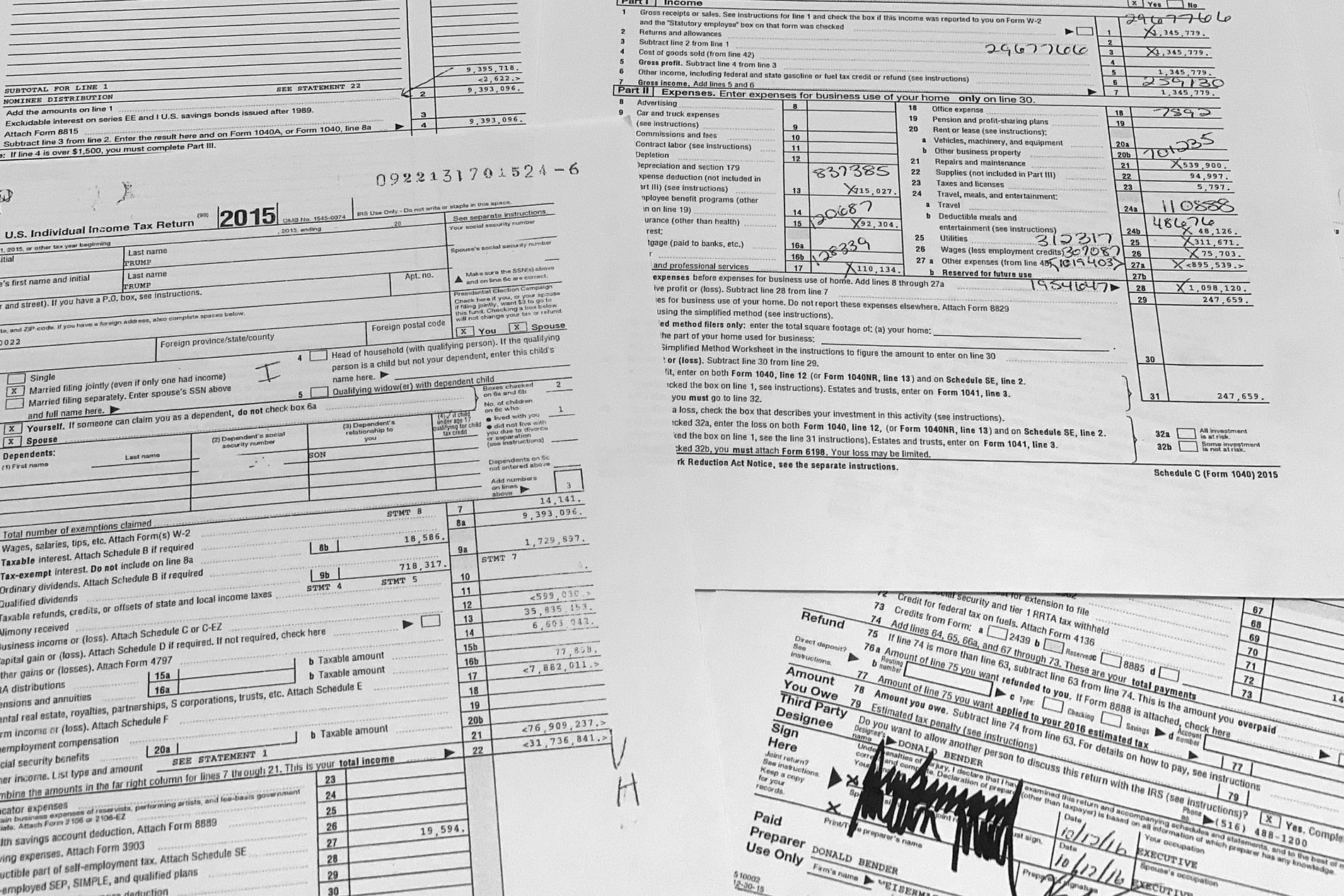

Today, the Democrat-led US Congress released Donald Trump’s tax returns from 2015 to 2020. He refused to follow the tradition of doing it himself.

The article has been updated.

Published one month after that The US Supreme Court has given the go-ahead for extradition.

In the documents released, there are personal tax papers and tax papers for parts of Trump’s business activities.

The exact contents of the documents are not yet known. A number of US newsrooms wrote shortly after the publication at 3pm Norwegian time that they were now working to sift through “thousands of pages of documents”.

Here are some results after the documents were announced:

- Trump, who said during his campaign that he would donate his presidential salary if he became president, gave no dollars to charity in 2020. The New York Times He also admittedly notes that Trump donated $500,000 in the previous two years, and nearly $2 million in 2017.

- Trump wrote that he has bank accounts in China, Great Britain, Ireland and the Caribbean island of Saint Martin Watchman.

- Trump announced about $16 million in losses through his companies in 2020.

Although the documents were announced today, the world already got an insight into the former president’s finances in the years 2015 to 2020 before Christmas, when the House of Representatives Congressional Tax Committee published a summary of some numbers from Trump’s tax returns in these years.

It emerged there that Trump, who for years boasted of being a highly successful businessman, paid a total of $1.13 million in national income tax in the middle of the two years of his presidency, while only paying $750 in tax in the first year.

Last year he paid zero taxes.

In 2016, the year he was elected, he also paid $750, while the previous year he paid over $640,000.

New York Times disclosure in 2020: This is how Trump avoided paying taxes

long legal battle

This low tax paid in this six year period comes despite the fact that he owns businesses and properties of enormous value. But because he claimed to incur large business losses in so many years in that period, he got away with minimal taxes.

In 2015, he claimed to have lost $105 million. The following year, $73 million.

After a lengthy legal battle, the documents have now been fully published (You can read the whole thing by clicking on Attachment E at the bottom of this committee press release external link). And so, American voters can finally see, with the help of a Democratic-led Congress, what it has always been tradition for presidents to do with themselves.

imitating trump, Who wants to be elected president again in 2024smash.

look at this? The Trump Organization was found guilty of tax fraud in New York

Trump is raging

He is not happy that this information is now available to the public. And in a video emailed to his followers on Friday, in which he also solicited donations for his 2024 presidential campaign, he said he “left a wonderful life to fight for the American people.”

– It wasn’t easy, but I’m glad I did it, he says, and continues:

Using a flagrant abuse of power, the Radical Democratic Congress illegally obtained and leaked my personal tax records, which only goes to show that I was extremely successful.

He describes it as a violation of the Constitution, but the Supreme Court, which therefore has a conservative majority with three justices appointed by Trump himself, among others, objected when they agreed a month ago to share the documents with Congress.

Trump calls it a “deranged witch hunt,” and believes the documents provide little information and are in any case nearly impossible for ordinary people to understand.

In a press release, the former president wrote that the great divide in the United States would now only get worse:

Democrats should never have done this. They use everything as a “weapon,” but remember that it’s a dangerous thing that can go either way.

Read also

The New York Times: Trump paid NOK 7,000 in taxes in 2016

Mandatory auditing did not occur

However, committee chair Richard Neal (D-) pointed out that the president is not just a taxpayer.

– They have unparalleled power and influence in America. Neal said why he thinks it’s important to be transparent about the president’s finances, with a great power.

Democrats on the committee believe it is important to be able to control that the president does not make his choices and priorities with ulterior motives in the service of his finances.

In a press release, the committee chair also indicated that they were expecting a compulsory audit of Trump’s tax papers by the tax authorities, as usual, but that did not happen.

– Our findings show that under the previous government (Trump government memorandum), this program was suspended. We now know that the first mandatory audit opened two years into the presidency, on the same day the committee requested access to the tax return.

Here, Trump announces his candidacy for the US elections in 2024:

Trump calls on Biden to take revenge

When the tax committee voted before Christmas on whether or not to make Trump’s tax returns public, all 24 Democrats voted in favor, while all 16 Republicans voted against. In three weeks, the Republicans will take the majority in the House of Representatives.

So the Democrats had to do it now if they had any hope of getting it done.

Trump is also calling on Republicans to retaliate by obtaining all financial documents of current President Joe Biden. He, ie Biden, has also voluntarily published all of his tax returns since 1998.

“Organizer. Social media geek. General communicator. Bacon scholar. Proud pop culture trailblazer.”