The bank’s management has put forward a proposal to reformulate the equity titles, including strengthening funds subject to regulatory classification as distributable.

In case it is A capital reduction of €1.725 million without changing the number of shares or status liquid. The change could free up capital to reward BCP shareholders, given that after two years without doing so, this year the bank returned to a dividend with A total dividend of 0.09 cents per share in June.Currently, BCP has 15,114 million shares that have been accepted for trading on the Lisbon Stock Exchange. Compared to Tuesday’s bid of €0.1459 per share, the company has a market capitalization of €2,205m.

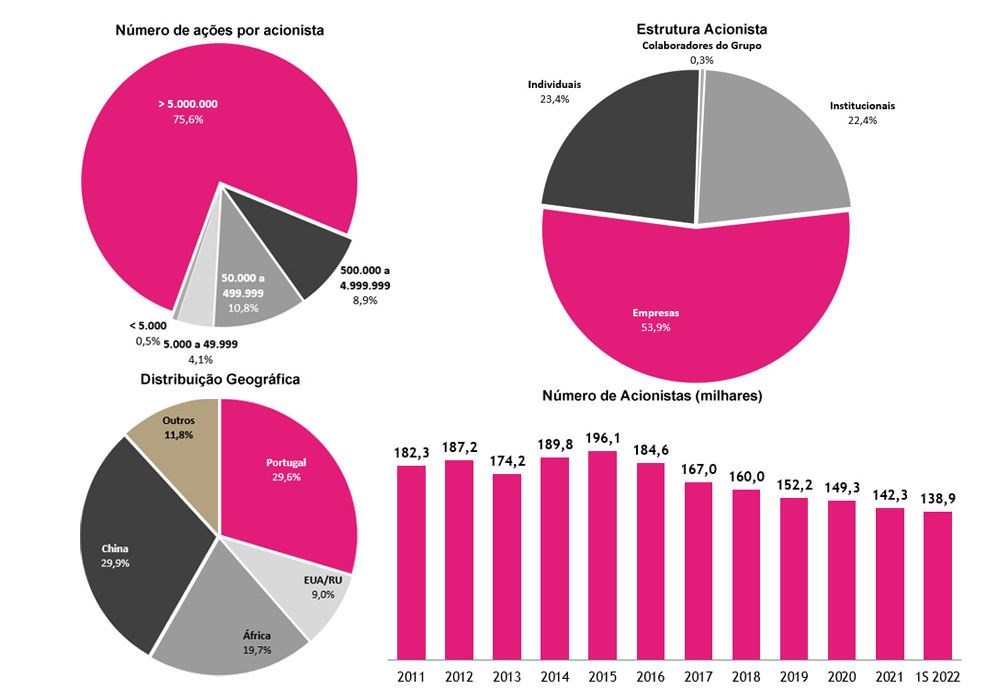

The largest shareholder – with 4,525,940,191 shares, equivalent to 29.95% of the share capital – is Fosun Group. It is followed by Sonangol, which owns 19.49% of the bank’s capital, with 2,946,353,914 shares.

Performance was driven by increasing income from the Group’s core business and managing recurring operating costs.

In addition to restating the stock titles, shareholders also voted affirmatively

Ratification of the joint option by the Board of Directors for two directors for the period that lasts until 2025 and the election of an alternate member of the Audit Committee for the same period.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”