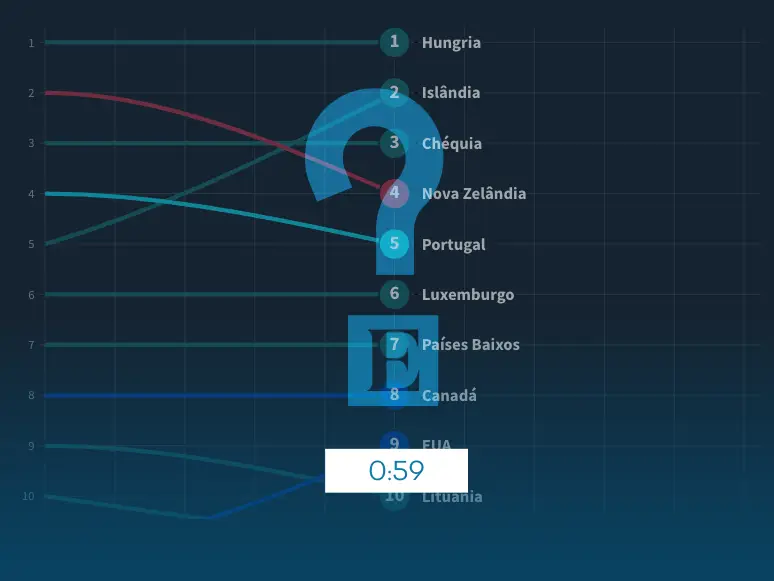

The graph goes back five years, to the first quarter of 2017, and shows the relative position of 46 OECD-OECD countries in the increase in real housing costs compared to 2015. As of the third quarter of 2017, Portugal has always been in the top 10 of the group and finishes the series in fifth place, behind Hungary, Iceland, Czech Republic and New Zealand.

With more affordable homes now than in 2015, there are Brazil, Saudi Arabia, South Africa and Italy as well as India and Indonesia – although the last number in these latter two cases is still from the fourth quarter of 2021. The remaining countries with values for For the first quarter of 2022, including Portugal, it has indicators above 100, that is, it made the real cost of housing more expensive.

The real cost of housing takes into account the nominal value of housing prices and household consumption expenditures in each country. The two indicators are seasonally adjusted and compared to the base value (2015 = 100).

Real cost of housing change

Compared to 2015 (Base 100)

Portugal (165.2) had a significantly higher index than the OECD average (134.3) and the eurozone average (127.7) in the first quarter of 2022. The Portuguese line has been moving away from the consistent manner of these two reference averages since 2015 (see chart above ).

Nominal Housing Cost Index

In Portugal and in OECD countries (2015 = 100)

Organization for Economic Cooperation and Development

The selling price of homes in Portugal has risen since the late 1980s – a long series of house price data from Organization for Economic Cooperation and Development In 1988 – until the crisis Mortgage in 2007. Years of crisis and low prices ensued until 2013.

The nominal cost of housing, which includes the selling price of new and used homes, has risen for eight consecutive years. Also in this case, Portugal has a much higher index (168.8) than the OECD average (145.2) compared to 2015 prices (=100).

Rental Price Index

In Portugal and the Eurozone (2015 = 100)

Organization for Economic Cooperation and Development

The rental price index also compares annual values with 2015 (=100). The Portuguese index has always been below the eurozone average until 2013. With the update of the oldest rents, the national market has been in line with the average of 19 countries and in the last two years the Portuguese index has been higher than the common currency partners. In other words, rent in Portugal was more expensive than in other countries in the same group.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”